One thing is for sure – life is filled with a series of unexpected events.

That’s why it’s critical to consider potential health risks when devising a financial plan.

Health and wealth are closely knit together in financial planning. Poor health habits almost always wind up costing people money and health care will be many people’s largest expense in retirement (Rozen, 2014). On the other hand, those who are healthy are more likely to exceed average life expectancy requiring a large nest egg to ensure they don’t outlive their assets.

Even the most well-intended plans can crumble in a second when faced with a sudden death, disability or long-term-care need. Based on your existing & hereditary health risks,

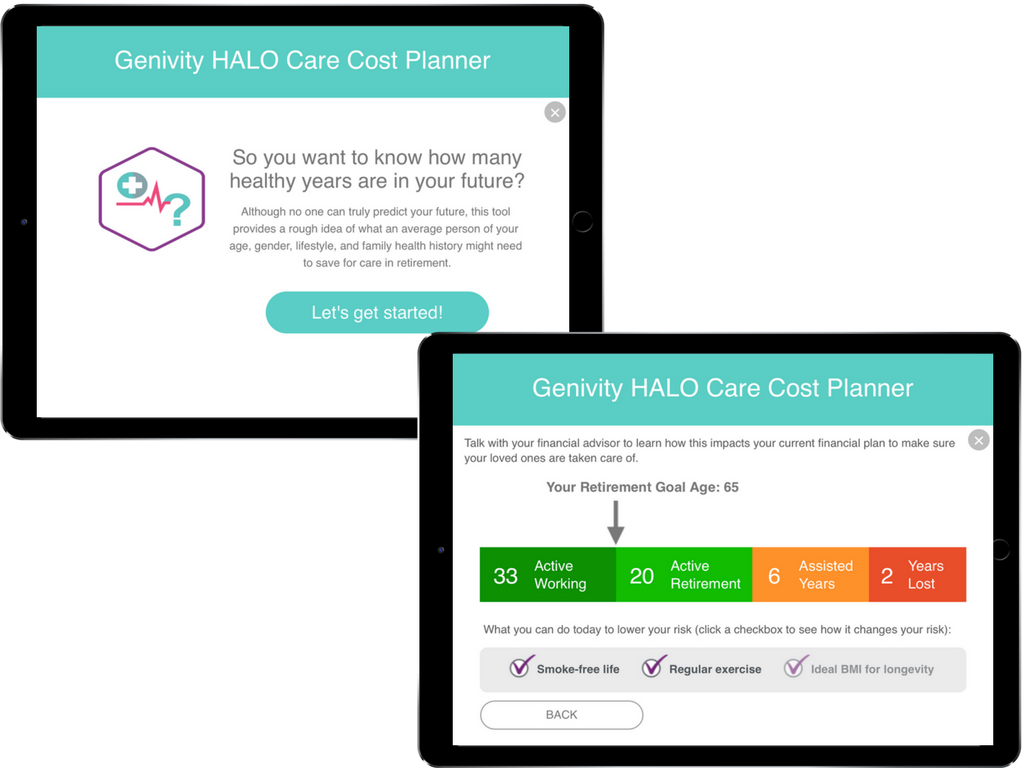

The Genivity HALO (Health Analysis & Longevity Optimizer) helps you understand:

- How many active and healthy years you can look forward to

- How many years where you’ll potentially need additional help with daily care (assisted living facilities / in-home care) and what your estimated costs would be for that care

- What to expect for out-of-pocket care costs throughout your lifespan and how those costs change at different life stages.