How to engage the family & put everyone’s minds at ease

It’s hard to grow old. It’s even harder to watch someone you love get old. But hardest of all is stepping in when age becomes an issue. Though this may seem like a family issue, stepping in at the right time is critical to your client’s financial future. “It’s like asking when it’s time to look for a new dentist. It’s right then, when you’re asking that question,” says Lyle Wolberg, Senior Financial Life Advisor and Partner at Telemus Capital. More importantly, in an increasingly holistic advising model, advisers should take an interest in their client’s health and well-being. So how do you know when to step in? Just like the dentist – if you’re reading this, you probably need the information.The Health-Wealth Connection: Your clients’ greatest fears are their children’s worst nightmare.

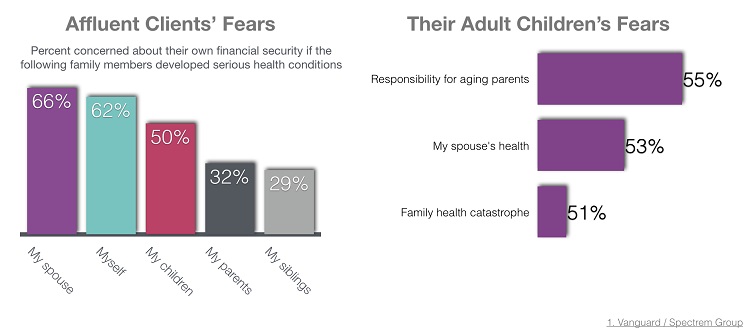

There are two worries lingering in the back of every parent’s mind: “Who is going to take care of me when I’m older?” “How can I avoid being a burden to my family?” Their adult children have the same fears, in addition to the responsibility of burdening their parents’ fears. This is a key opportunity for advisors to step in and help show the family the steps that have been taken to preserve wealth and cover care needs.| Affluent Clients’ Fears | Their Adult Children’s Fears |

| Percent concerned about their own financial security if the following family members developed serious health conditions | Top concerns of affluent adult children are health related |

Advisors as trusted support systems for their clients

A financial advising team can become a family’s trusted yet unbiased support system. Through annual team-wide meetings, you can develop a relationship with your client and their family. Even though adult children don’t have full, if any, control over their parent’s finances, it’s important that they feel welcome at the table. In an interview, Lyle from Telemus Capital confirms that “If you have this trusted adviser team, it’s so much easier for a child or spouse to come to the team. You cannot insert yourself in a client’s family, but you can certainly make them feel welcome in yours. As your clients age, this relationship is the first step at confronting your client’s issue. It may be hard for them to hear from their child that they should no longer have full control over their finances. It’s much easier to hear this from an entire team of independent advisers. There is power in numbers.”

In this conversation, financial advisers have a set of tools to limit, but not remove, their client’s autonomy. Lyle notes that all of these changes should be gradual. After all, clients are used to controlling their own wealth. Rather than eliminating their access to checking accounts, advisers can instead require that all withdrawals and checks must have two signatures. Your client will maintain the feeling that they can spend money freely, while their habits are checked by a spouse or adult child. Advisers can also set up automatic bill paying to reduce their involvement in wealth management. However, Lyle reminds us that phrasing is key. Advisers should emphasize that it’s a service to lessen their client’s burden, not a punishment for their aging. He suggests the following approach as a way for an advisor to start the conversation: “Let’s take away some of the day-to-day responsibility for you guys, so you don’t have to worry about paying your bills and you can enjoy your retirement.” Confronting these issues will always be a unique experience for children and advisers. A client’s specific situation and reaction will vary from one experience to the next, but involving family members as early as possible is key to the success of every case. GenivityFamily can help you start these conversations by helping advisors engage clients and the clients’ families in understanding their health risks and care costs. This value-added service provides an opportunity to deepen client relationships with both spouses and their adult children in conversations about decisions about caregiving, end-of-life decisions and wealth transfer.

Lyle Wolberg

SENIOR FINANCIAL LIFE ADVISOR, PARTNER, TELEMUS

Lyle is one of the founding Partners of Telemus and is responsible for working with some of the firm’s largest relationships. As a former Financial Advisor at Merrill Lynch and Senior Vice President–Investments at UBS Financial Services, Lyle has more than 21 years of industry experience across all facets of financial wealth planning and investment management. Lyle is a Certified Financial Planner and a member of the Financial Planning Association.